Water & Sewer Line Construction Industry - Market Research Report

Industry Overview

This industry comprises establishments primarily engaged in the construction of water and sewer lines, mains, pumping stations, treatment plants, and storage tanks. The work performed may include new work, reconstruction, rehabilitation, and repairs. Specialty trade contractors are included in this industry if they are engaged in activities primarily related to water, sewer line, and related structures construction. All structures (including buildings) that are integral parts of water and sewer networks (e.g., storage tanks, pumping stations, water treatment plants, and sewage treatment plants) are included in this industry. Illustrative Examples: Distribution line, sewer and water, construction Sewer main, pipe and connection, construction Fire hydrant installation Storm sewer construction Irrigation systems construction Water main and line construction Sewage disposal plant construction Pumping station, water and sewage system, construction Water system storage tank and tower construction Reservoir construction Water treatment plant construction Water well drilling, digging, boring, or sinking (except water intake wells in oil and gas fields)

Source: U.S. Census BureauMarket Size and Industry Forecast

This research report analyzes the market size and trends in the Water and Sewer Line Construction industry. It shows overall market size from 2020 to the present, and predicts industry growth through 2030. Revenues data include both public and private companies.

| Historical | Forecasted |

|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|

| Market Size (Total Revenue) | Included in Report |

| % Growth Rate |

| Number of Companies |

| Total Employees |

| Average Revenue per Company |

| Average Employees per Company |

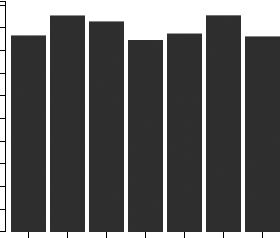

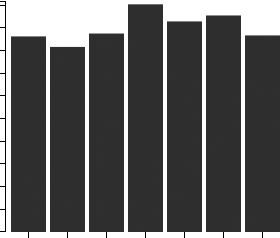

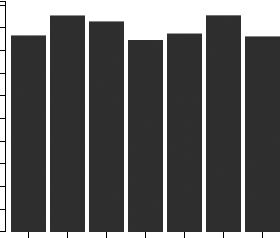

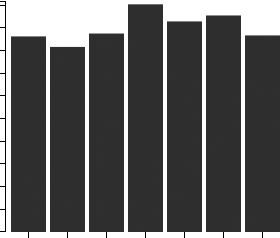

Source: U.S. government financial dataIndustry Revenue ($ Billions)

Industry Forecast ($ Billions)

Advanced econometric models forecast five years of industry growth based on short- and long-term trend analysis. Market size includes revenue generated from all products and services sold within the industry.

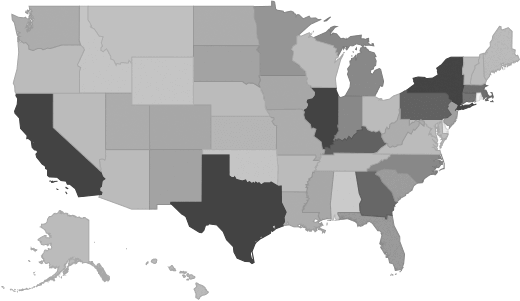

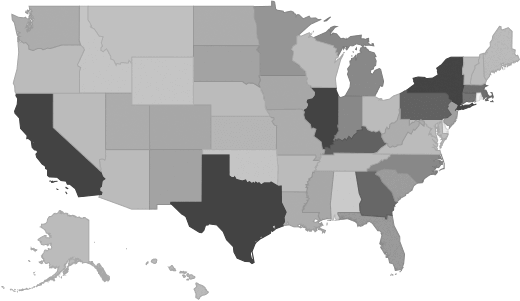

Geographic Breakdown by U.S. State

Market size by state reveals local opportunity through the number of companies located in the region. Each state's growth rate is affected by regional economic conditions. Data by state can be used to pinpoint profitable and nonprofitable locations for Water & Sewer Line Construction companies in the United States.

Water & Sewer Line Construction Revenue by State

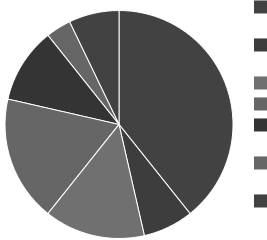

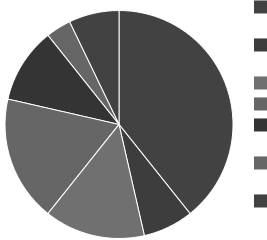

Distribution by Company Size

| Company Size | All Industries | Water & Sewer Line Construction |

|---|

| Small Business (< 5 Employees) | Included |

| Small Business (5 - 20) |

| Midsized Business (20 - 100) |

| Large Business (100 - 500) |

| Enterprise (> 500) |

Water & Sewer Line Construction Industry Income Statement (Average Financial Metrics)

Financial statement analysis determines averages for the following industry forces:

- Cost of goods sold

- Compensation of officers

- Salaries and wages

- Employee benefit programs

- Rent paid

- Advertising and marketing budgets

The report includes a traditional income statement from an "average" company (both public and private companies are included).

| Industry Average | Percent of Sales |

|---|

| Total Revenue | Included |

| Operating Revenue |

| Cost of Goods Sold (COGS) |

| Gross Profit |

| Operating Expenses |

| Operating Income |

| Non-Operating Income |

| Earnings Before Interest and Taxes (EBIT) |

| Interest Expense |

| Earnings Before Taxes |

| Income Tax |

| Net Profit |

Average Income Statement

Cost of Goods Sold

Salaries, Wages, and Benefits

Rent

Advertising

Depreciation and Amortization

Officer Compensation

Net Income

Financial Ratio Analysis

Financial ratios allow a company's performance to be compared against that of its peers.

| Financial Ratio | Industry Average |

|---|

| Profitability Ratios | Included |

| Profit Margin |

| ROE |

| ROA |

| Liquidity Ratios |

| Current Ratio |

| Quick Ratio |

| Activity Ratios |

| Average Collection Period |

| Asset Turnover Ratio |

| Receivables Turnover Ratio |

| Inventory Conversion Ratio |

Salary information for employees working in the Water & Sewer Line Construction industry.

| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|

| Management Occupations | 6% | Included |

| Chief Executives | 0% |

| General and Operations Managers | 2% |

| Office and Administrative Support Occupations | 7% |

| Construction and Extraction Occupations | 55% |

| Supervisors of Construction and Extraction Workers | 7% |

| First-Line Supervisors of Construction Trades and Extraction Workers | 7% |

| First-Line Supervisors of Construction Trades and Extraction Workers | 7% |

| Construction Trades Workers | 43% |

| Construction Laborers | 21% |

| Construction Laborers | 21% |

| Construction Equipment Operators | 10% |

| Operating Engineers and Other Construction Equipment Operators | 10% |

| Pipelayers, Plumbers, Pipefitters, and Steamfitters | 6% |

| Installation, Maintenance, and Repair Occupations | 16% |

| Other Installation, Maintenance, and Repair Occupations | 13% |

| Line Installers and Repairers | 10% |

| Electrical Power-Line Installers and Repairers | 7% |

| Transportation and Material Moving Occupations | 5% |

Government Contracts

The federal government spent an annual total of

$505,828,622 on the water & sewer line construction industry. It has awarded 2,801 contracts to 760 companies, with an average value of $665,564 per company.

Top Companies in Water & Sewer Line Construction and Adjacent Industries

| Company | Address | Revenue

($ Millions) |

|---|

Included |