- (800) 311-5355

- Contact Us

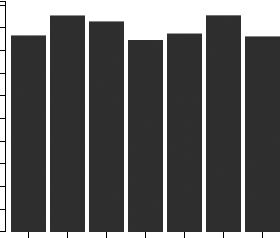

| Historical | Forecasted | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| Market Size (Total Revenue) | Included in Report | ||||||||||

| % Growth Rate | |||||||||||

| Number of Companies | |||||||||||

| Total Employees | |||||||||||

| Average Revenue per Company | |||||||||||

| Average Employees per Company | |||||||||||

| Company Size | All Industries | Asphalt Shingle & Coating Materials Manufacturing |

|---|---|---|

| Small Business (< 5 Employees) | Included | |

| Small Business (5 - 20) | ||

| Midsized Business (20 - 100) | ||

| Large Business (100 - 500) | ||

| Enterprise (> 500) | ||

| Industry Average | Percent of Sales | |

|---|---|---|

| Total Revenue | Included | |

| Operating Revenue | ||

| Cost of Goods Sold (COGS) | ||

| Gross Profit | ||

| Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| Earnings Before Interest and Taxes (EBIT) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit | ||

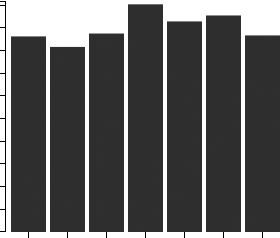

Cost of Goods Sold

Salaries, Wages, and Benefits

Rent

Advertising

Depreciation and Amortization

Officer Compensation

Net Income

| Financial Ratio | Industry Average |

|---|---|

| Profitability Ratios | Included |

| Profit Margin | |

| ROE | |

| ROA | |

| Liquidity Ratios | |

| Current Ratio | |

| Quick Ratio | |

| Activity Ratios | |

| Average Collection Period | |

| Asset Turnover Ratio | |

| Receivables Turnover Ratio | |

| Inventory Conversion Ratio |

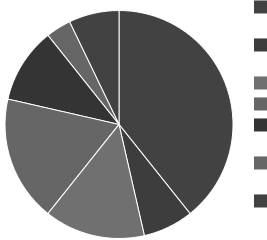

| Product Description | Description | Revenue ($ Millions) | |

|---|---|---|---|

Asphalt shingle and coating materials mfg. | Included | ||

Roofing asphalts and pitches, coatings, and cements | |||

Roofing asphalt | |||

Fibrated and nonfibrated asphaltic roofing coatings | |||

Fibrated asphaltic roofing coatings | |||

Nonfibrated asphaltic roofing coatings | |||

Other roofing asphalts and pitches, coatings, and cements | |||

Asphaltic roofing cements | |||

Roofing asphalts and pitches, coatings, and cements, nsk | |||

Prepared asphalt and tar roofing and siding products | |||

| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 6% | Included | ||

| Chief Executives | 0% | |||

| General and Operations Managers | 2% | |||

| Architecture and Engineering Occupations | 10% | |||

| Engineers | 9% | |||

| Office and Administrative Support Occupations | 7% | |||

| Construction and Extraction Occupations | 8% | |||

| Construction Trades Workers | 6% | |||

| Installation, Maintenance, and Repair Occupations | 9% | |||

| Other Installation, Maintenance, and Repair Occupations | 7% | |||

| Production Occupations | 41% | |||

| Supervisors of Production Workers | 6% | |||

| First-Line Supervisors of Production and Operating Workers | 6% | |||

| First-Line Supervisors of Production and Operating Workers | 6% | |||

| Plant and System Operators | 20% | |||

| Miscellaneous Plant and System Operators | 20% | |||

| Petroleum Pump System Operators, Refinery Operators, and Gaugers | 18% | |||

| Other Production Occupations | 11% | |||

| Transportation and Material Moving Occupations | 7% | |||

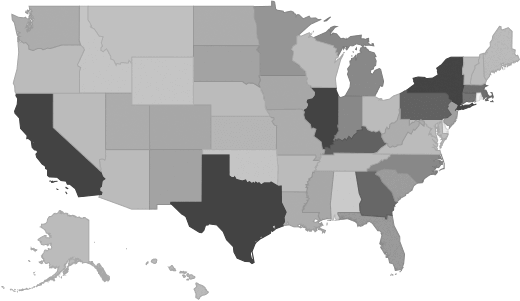

| Company | Address | Revenue ($ Millions) |

|---|---|---|

Included | ||