General Freight Trucking Industry - Market Research Report

Industry Overview

This industry group comprises establishments primarily engaged in providing general freight trucking. General freight trucking establishments handle a wide variety of commodities, generally palletized, and transported in a container or van trailer. The establishments of this industry group provide a combination of the following network activities: local pick-up, local sorting and terminal operations, line-haul, destination sorting and terminal operations, and local delivery.

Source: U.S. Census BureauMarket Size and Industry Forecast

This research report analyzes the market size and trends in the General Freight Trucking industry. It shows overall market size from 2020 to the present, and predicts industry growth through 2030. Revenues data include both public and private companies.

| Historical | Forecasted |

|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|

| Market Size (Total Revenue) | Included in Report |

| % Growth Rate |

| Number of Companies |

| Total Employees |

| Average Revenue per Company |

| Average Employees per Company |

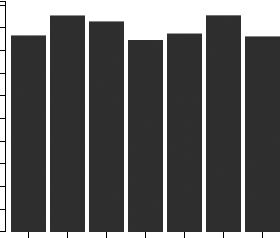

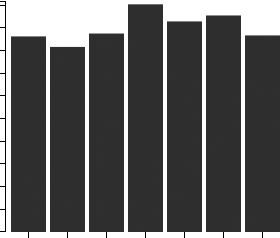

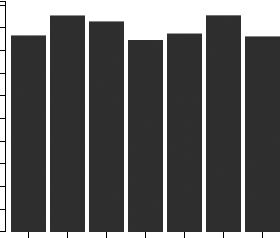

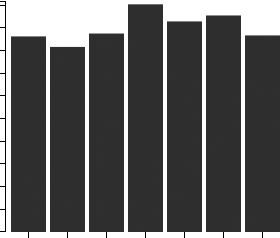

Source: U.S. government financial dataIndustry Revenue ($ Billions)

Industry Forecast ($ Billions)

Advanced econometric models forecast five years of industry growth based on short- and long-term trend analysis. Market size includes revenue generated from all products and services sold within the industry.

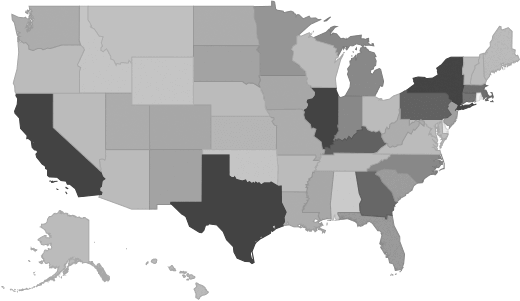

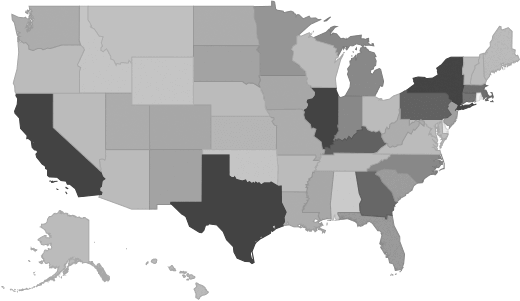

Geographic Breakdown by U.S. State

Market size by state reveals local opportunity through the number of companies located in the region. Each state's growth rate is affected by regional economic conditions. Data by state can be used to pinpoint profitable and nonprofitable locations for General Freight Trucking companies in the United States.

General Freight Trucking Revenue by State

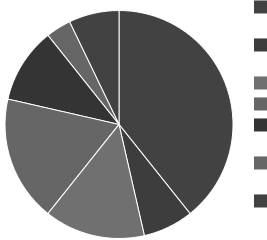

Distribution by Company Size

| Company Size | All Industries | General Freight Trucking |

|---|

| Small Business (< 5 Employees) | Included |

| Small Business (5 - 20) |

| Midsized Business (20 - 100) |

| Large Business (100 - 500) |

| Enterprise (> 500) |

General Freight Trucking Industry Income Statement (Average Financial Metrics)

Financial statement analysis determines averages for the following industry forces:

- Cost of goods sold

- Compensation of officers

- Salaries and wages

- Employee benefit programs

- Rent paid

- Advertising and marketing budgets

The report includes a traditional income statement from an "average" company (both public and private companies are included).

| Industry Average | Percent of Sales |

|---|

| Total Revenue | Included |

| Operating Revenue |

| Cost of Goods Sold (COGS) |

| Gross Profit |

| Operating Expenses |

| Operating Income |

| Non-Operating Income |

| Earnings Before Interest and Taxes (EBIT) |

| Interest Expense |

| Earnings Before Taxes |

| Income Tax |

| Net Profit |

Average Income Statement

Cost of Goods Sold

Salaries, Wages, and Benefits

Rent

Advertising

Depreciation and Amortization

Officer Compensation

Net Income

Financial Ratio Analysis

Financial ratios allow a company's performance to be compared against that of its peers.

| Financial Ratio | Industry Average |

|---|

| Profitability Ratios | Included |

| Profit Margin |

| ROE |

| ROA |

| Liquidity Ratios |

| Current Ratio |

| Quick Ratio |

| Activity Ratios |

| Average Collection Period |

| Asset Turnover Ratio |

| Receivables Turnover Ratio |

| Inventory Conversion Ratio |

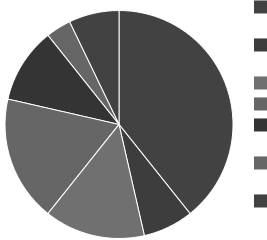

Products and Services Mix

Product lines and services in the General Freight Trucking industry accounting for the largest revenue sources.

| Product Description | Description | Revenue

($ Millions) |

|---|

| Industry total | Included |

| Trans box & pallet gds no clim-ctrl, except intrmdl tnk cont, rd, tl |

| Trans box & pallet gd, no clim-ctrl, except intrmd tnk cont, rd, ltl |

| Transportation of other goods by road |

| Trans of clim-contld box & pallet gds except intermdl tank conts, rd |

| Trans of dry bulks, except in intermodal tank containers, by road |

| Transportation of other intermodal containers, nec, by road |

| Warehousing services |

| Trans of bulk lqds & gases, except in intermodal tank conts, by road |

| Trans of bulk liquids & gases in intermodal tank conts by road |

Salary information for employees working in the General Freight Trucking industry.

| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|

| Management Occupations | 3% | Included |

| Chief Executives | 0% |

| General and Operations Managers | 1% |

| Office and Administrative Support Occupations | 12% |

| Transportation and Material Moving Occupations | 76% |

| Motor Vehicle Operators | 63% |

| Driver/Sales Workers and Truck Drivers | 63% |

| Heavy and Tractor-Trailer Truck Drivers | 60% |

| Material Moving Workers | 10% |

| Laborers and Material Movers, Hand | 8% |

| Laborers and Freight, Stock, and Material Movers, Hand | 7% |

Government Contracts

The federal government spent an annual total of

$69,502,337 on the general freight trucking industry. It has awarded 771 contracts to 173 companies, with an average value of $401,748 per company.

Top Companies in General Freight Trucking and Adjacent Industries

| Company | Address | Revenue

($ Millions) |

|---|

Included |