2025 Printing Industry Report

Industry Overview

Industries in the Printing and Related Support Activities subsector print products, such as newspapers, books, labels, business cards, stationery, business forms, and other materials, and perform support activities, such as data imaging, platemaking services, and bookbinding. The support activities included here are an integral part of the printing industry, and a product (a printing plate, a bound book, or a computer disk or file) that is an integral part of the printing industry is almost always provided by these operations. Processes used in printing include a variety of methods used to transfer an image from a plate, screen, film, or computer file to some medium, such as paper, plastics, metal, textile articles, or wood. The printing processes employed include, but are not limited to, lithographic, gravure, screen, flexographic, digital, and letterpress. In contrast to many other classification systems that locate publishing of printed materials in manufacturing, NAICS classifies the publishing of printed products in Subsector 511, Publishing Industries (except Internet). Though printing and publishing are often carried out by the same enterprise (a newspaper, for example), it is less and less the case that these distinct activities are carried out in the same establishment. When publishing and printing are done in the same establishment, the establishment is classified in Sector 51, Information, in the appropriate NAICS industry even if the receipts for printing exceed those for publishing. This subsector includes printing on clothing because the production process for that activity is printing, not clothing manufacturing. For instance, the printing of T-shirts is included in this subsector. In contrast, printing on fabric (or grey goods) is not included. This activity is part of the process of finishing the fabric and is included in the Textile Mills subsector in Industry 31331, Textile and Fabric Finishing Mills.

Source: U.S. Census BureauMarket Size and Industry Forecast

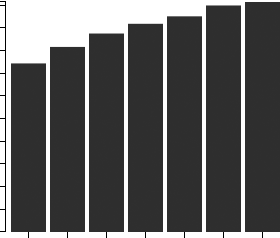

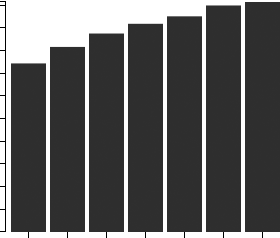

The Printing industry report contains historical and forecasted statistics used by leading private equity firms and consultants. Market sizes from 2020 to 2030 reflect industry trends and growth patterns. Revenues include both public and private companies in the Printing industry.

Source: U.S. government financial dataIndustry Revenue ($ Billions)

Advanced econometric models forecast five years of industry growth based on short- and long-term trend analysis. Market size includes revenue generated from all products and services sold within the industry.

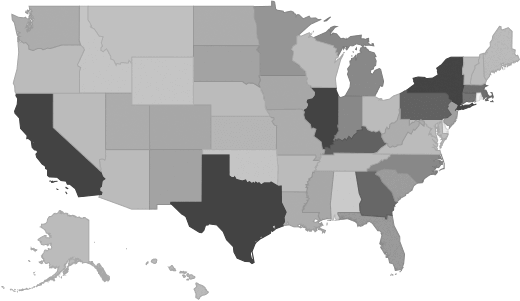

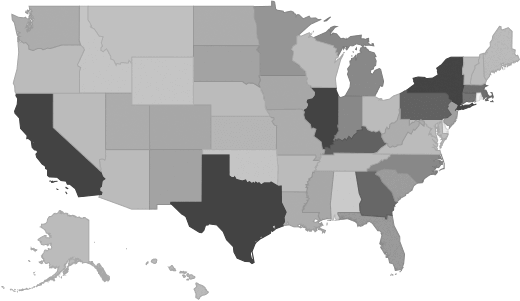

Geographic Breakdown by U.S. State

Market size by state reveals local opportunity through the number of companies located in the region. Each state's growth rate is affected by regional economic conditions. Data by state can be used to pinpoint profitable and nonprofitable locations for Printing companies in the United States.

Printing Revenue by State

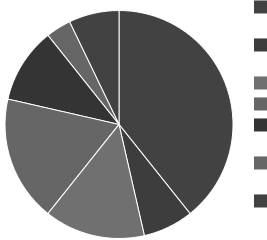

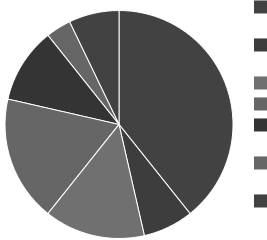

Distribution by Company Size

Printing Industry Income Statement (Average Financial Metrics)

Financial statement analysis determines averages for the following industry forces:

- Cost of goods sold

- Compensation of officers

- Salaries and wages

- Employee benefit programs

- Rent paid

- Advertising and marketing budgets

The report includes a traditional income statement from an "average" company (both public and private companies included).

Average Income Statement

Cost of Goods Sold

Salaries, Wages, and Benefits

Rent

Advertising

Depreciation and Amortization

Officer Compensation

Net Income

Financial Ratio Analysis

Financial ratios allow a company's performance to be compared against that of its peers.

Government Contracts

The federal government spent an annual total of

$51,030,440 on the printing industry. It has awarded 2,906 contracts to 505 companies, with an average value of $101,050 per company.

Top Companies in Printing and Adjacent Industries

Report ObjectivesFor Private Equity Firms & Investors

- Analyze unbiased statistics for the Printing market

- Review historical and forecasted growth trends

- Benchmark companies against the industry average

For Business Executives

- Develop a strategy based on concrete statistics

- Identify opportunities based on market size and growth rates

For Startups

- Get the information you need for the "Market Analysis" section of your business plan

- Show market size in the U.S. and by state

For Venture Capital

- Understand market opportunity and current size

- Evaluate the market potential of a disruptive technology in the Printing industry